Hear me out on KVUE: Part II

Thesis just got stronger, reiterating a special action on divestiture soon!

Thank you for all the love on my previous analysis on the KVUE trade thesis: Hear Me Out on KVUE. Many subscribers reached out to ask for my thoughts on KVUE after its recent earnings call. So let’s dissect KVUE’s latest earnings call to uncover clues about what’s ahead. (Spoiler alert: The call was filled with tiny hints)

Recall from our previous analysis that KVUE’s 10-K contains a covenant blocking acquisitions, spin-offs, divestitures, or major actions until August 23, 2025. Earlier this year, multiple activist investors started taking positions in KVUE, pushing for a full sale or for non-performing assets to be unlocked.

Now, let’s dive into the recent earnings call and what KVUE’s leadership hinted at:

“I wanted to share some initial observations which have informed our immediate priorities. There is a significant amount of complexity across the organization, whether it comes to SKUs, brands, or even countries. We can't be everything to everyone and we need to be more choiceful on where to play and how to win.”

KVUE clearly has multiple brands and SKUs that don’t contribute evenly to top- or bottom-line growth. This points to a likely evaluation—and possible sale—of brands that don’t deliver strong margins or competitive positioning.“Kenvue has an iconic brand portfolio with so much potential. Potential without performance doesn't matter.”

In my opinion, this refers to the struggling Skin, Health & Beauty (SHB) segment, which owns big names like Neutrogena and Aveeno. Despite being household brands, they’ve lost share to L’Oréal’s Cerave, La Roche Posay, Cetaphil, and others. This strongly suggests SHB could be put up for sale. (Our previous analysis valued this segment at around $17 billion.)“We need to focus, and as I mentioned in terms of the number of brands, as an example, the contributory three-quarters of our sales, the long tail of SKUs that make up less than 1% of our sales, great innovation pipeline, but just too many initiatives.”

Again, it’s a hint that while KVUE has strong brands, these brands can no longer be effectively managed under one umbrella. I highly doubt they will simply discontinue them—instead, I’d put more odds on monetizing those assets by putting them up for sale.

One of the best hints came during Q&A, when an analyst asked:

“Kirk, you were at P&G where the turnaround and reduction of complexity involved actual business divestitures in attractive categories. Procter divested pet care, fragrances. The concept there was that retail and competitive dynamics were structurally challenged. Could you discuss your views on the framework, how the board is looking to unlock value—say, in skin health where profitability is lowest and competition intense?”

The CEO sidestepped specifics but said something telling:

“You're right in pointing out that there are different elements of the P&G turnaround. What’s very similar is our iconic and resilient brands.”

In other words: Just like P&G divested brands to focus on its core winners, KVUE has potential with strong brands that could weather strategic shifts.

This P&G comparison got me thinking: what exactly happened during their turnaround, and could KVUE follow the same path?

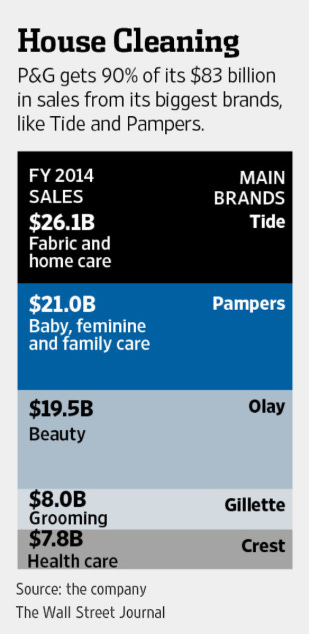

Between 2014–2016, P&G’s revenue was dominated by a few core brands, while many others struggled.

The company ended up selling or discontinuing about 100 brands and famously sold 12 beauty brands to Coty for $12 billion. That move aligns perfectly with our thesis that KVUE’s Skin Health & Beauty segment could be next on the block.

Note: Once P&G announced the sale of its brands, the stock returned ~18% in the next four months. A nice quick return.

Let’s recap the catalyst timeline from our last analysis again for fun:

Timeline:

March 5: KVUE appoints Starboard CEO to its board — NICE

March 23: Reports that TOMS Capital has taken a stake (confirmed via 13F) and is pushing for a sale — GREAT

April 25: Reports that Third Point has also taken a stake (confirmed via 13F) — Are you kidding me? Three activists? SWEET

May 8: KVUE appoints new CFO Amit Banati

Pay attention here: this guy comes from Kellogg, which split into two segments. Banati moved with Kellanova, which got acquired — and so did the other piece.

But drum roll: TOMS Capital was pushing for a sale at Kellanova too. Two months after these activists show up, their “star CFO” joins the company? Come on.

July 11: CNBC’s David Faber reports KVUE’s board is listening to activists pushing for a sale — this was the last piece I needed to initiate.

July 14: KVUE announces CEO stepping down immediately (thank god), and forms a strategic committee to evaluate all options to unlock shareholder value. They also pre-reported bad Q2 numbers and hinted at a guide cut — and the stock went up. Because right now, the numbers don’t matter.

To conclude:

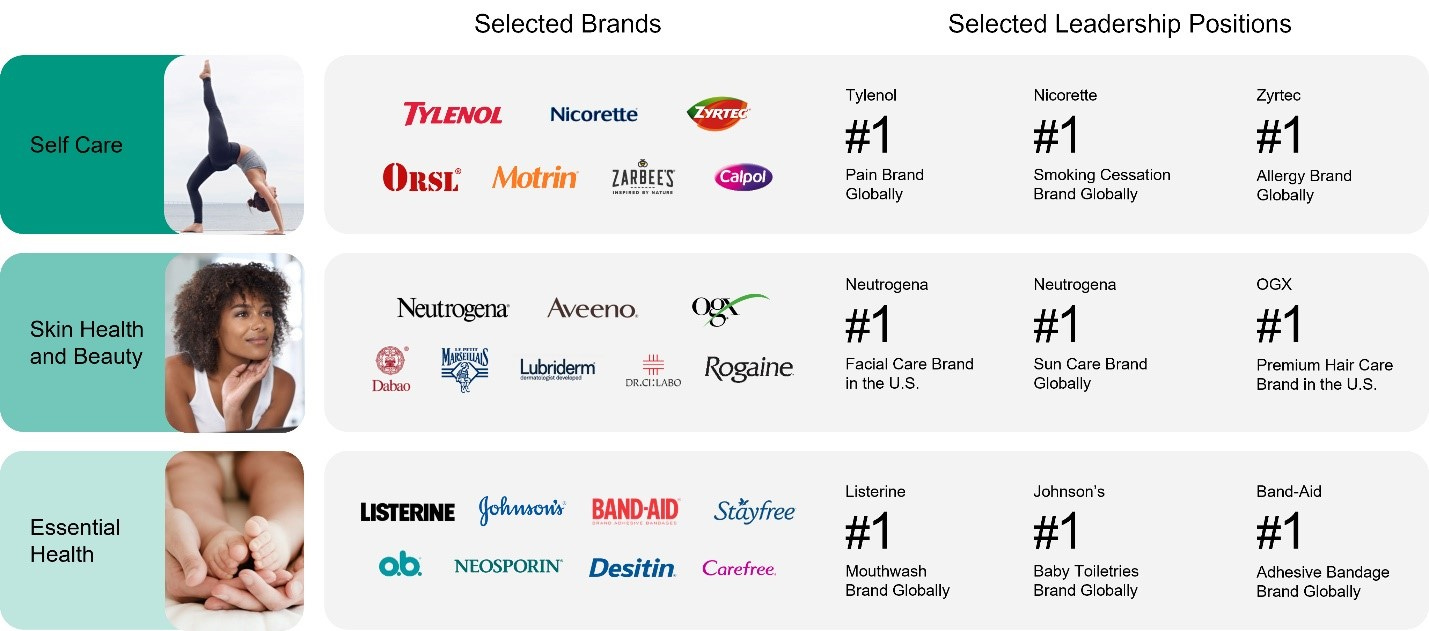

KVUE remains a trade for me. The likelihood of a major divestiture, spin-off, or portfolio simplification is increasing. With activists still involved and a new CFO and CEO who both have a history of spin-offs and brand sales, my conviction only grows stronger. I’ll leave you with this nice representation of the brands under KVUE umbrella

As always this is not investment advice, please do your own due diligence.

I really enjoyed Part II. I like the 'reading between the lines' stuff. Keepe 'em coming !! The only thing that worries me here on KVUE is the debt load ($8.6bn as of latest Q). Also, they basically pay out all of their FCF on the div. Though, I guess this is + for the thesis, not negative.