Buyside earnings setup on RDDT!

Quick setup details on what buyside bar is on RDDT earnings

Before we begin, thanks for all the love on my last RDDT post — appreciate everyone who read, shared, and reached out. As promised, here’s a deep dive into the upcoming earnings setup and what actually matters for the stock.

RDDT will report earnings Thursday Night, July 31. Since last earnings, the stock has gained much of its lost momentum — although not all of it. This will be a key quarter to disprove the bear thesis on RDDT (RDDT Bear Thesis link to previous Substack post on RDDT bear thesis).

Cutting to the chase, here are some pointers to understand from the perspective of how stocks move. And trust me, I do this for a living — I work at a hedge fund, I analyze multiple earnings setups, and I speak to Wall Street analysts regularly.

Before we begin, understand this:

A stock with high multiples and momentum like RDDT moves more on buyside expectations than sell-side — because buyside is the one that decides whether the multiple is still justified or not.

No one really cares about the quarter — thanks to services like Yipit, Ahrefs, Semrush, and others, there’s already a good read on how the quarter will land. The stock didn’t go from $120 to $150 on nothing — it moved higher on improving DAU trends and continued strong traffic after a dip in April.

So what's new and will move the stock? The guidance.

Let’s Get Into the Earnings Setup

I went back and played a two-part game to analyze how this setup could play out:

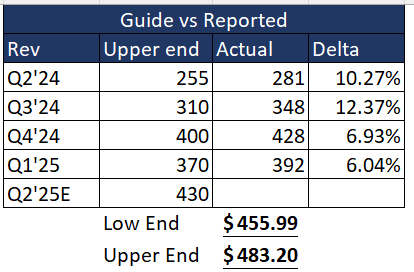

Part A: “Guide vs Reported”

In this, I look at what Reddit guides on revenue and how much they usually beat by

Based on that, I expect RDDT to report Q2 revenue between $455–$480M.

Even though consensus is at $425M, the buyside bar (what buyside needs to see) is closer to $450M. That’s not too concerning in my opinion — it’s within reach based on historical beats.

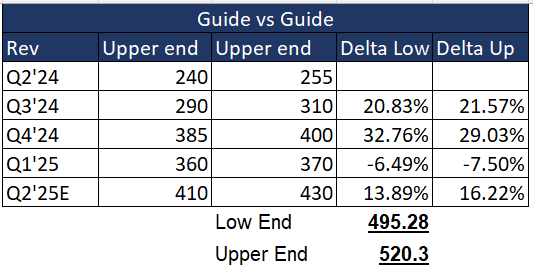

Part B: “Guide vs Guide”

In this, I look at what Reddit guides next quarter at — based on their guide from the current quarter.

There’s a lot of seasonality in this since ad dynamics vary quarter to quarter (especially around holidays), so I focused just on how Q2 to Q3 guidance has trended in the past.

Based on that, I would expect a Q3 revenue guide in the range of $496–$520M.

Consensus is sitting at $472M, while buyside likely wants to see $480–$500M.

Playing a similar Part A / Part B game on EBITDA, I would expect Q3 EBITDA to be guided between $163–$182M vs consensus of $159M and buyside bar around $175–$185M.

I do find the buyside bar slightly high, but not a big enough issue to say “run for the doors.”

Now the Important One – DAUs

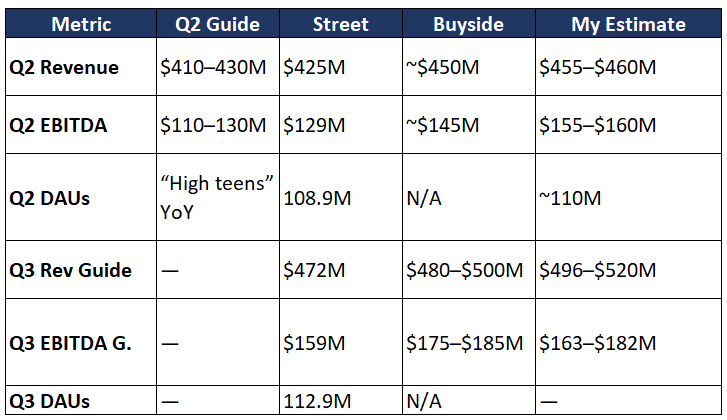

For Q2, I’ve been tracking Similarweb data and doing a historical error analysis on it. Based on that, I would expect an in-line to slight beat on DAUs — around 110M vs 108.9M consensus.

There’s no real buyside consensus on this, but no one is expecting a gangbuster beat on DAUs either.

What I really hope is that Reddit doesn’t decide to guide Q3 DAUs again based on just a few weeks of data. As we’ve seen, trends can change quickly — whether it’s a new Google algo change, or some random platform spike.

But just in case they do, let’s be prepared.

Q3 DAUs are expected to grow ~3–4% Q/Q to hit 113M.

To be fair, I don’t have a great read on Q3 yet — seasonality and DAU growth is all over the place. But one thing I’d note is Citi recently pointed out July DAU trends have been stable M/M, so I’m personally fine with the 3% Q/Q growth estimate. In fact, I’d prefer if street expectations come down, so the setup gets easier to beat.

Also worth noting: multiple ad checks from Deutsche and others show continued acceleration in Q2 and Q3, so I’m comfortable on sales.

My Conclusion

I think the setup looks attractive. There’s potential for upside surprises given positioning is still short among many funds, although I suspect shorts have covered in the face of better trends.

The only real caveat is whether management decides to guide DAUs and ends up giving bears the narrative again — like they did last quarter.

I would expect the Q&A to be filled with questions on July DAU trends. Hopefully, management just sticks to the message — like Google did — and says they won’t comment on Q3 trends based on a few weeks. It’s a futile exercise.

Summary Table – Where Expectations Stand

Let me know what your thoughts are on the setup in the comments below.

– Buyside Guy

If you like what you read, consider subscribing (it’s free). All it does is encourage me to stay consistent and keep sharing insights — straight from the perspective of a hedge fund analyst.